Lacy Lakeview Auto Title Loans offer San Antonio residents a swift and accessible financial solution, allowing them to tap into their vehicle's equity with less stringent requirements. Ideal for those with limited credit options, the process involves verifying ownership, ID, and income. Approved applicants can gain quick access to funds for various purposes. When choosing a lender, critically analyze customer reviews, focus on transparency, interest rates, and service; compare lenders for competitive rates and flexible options; assess repayment ability; and explore various repayment choices to secure optimal terms.

Lacy Lakeview auto title loans offer a unique financial solution for those needing quick cash. Before securing a loan, understanding the process and reading genuine customer reviews is crucial. This article guides you through navigating Lacy Lakeview auto title loans, focusing on key aspects like reading and interpreting customer feedback and tips to secure favorable loan terms. By following these insights, you can make informed decisions and access the best financial support.

- Understanding Lacy Lakeview Auto Title Loans

- Reading and Interpreting Customer Reviews

- Tips for Securing the Best Loan Terms

Understanding Lacy Lakeview Auto Title Loans

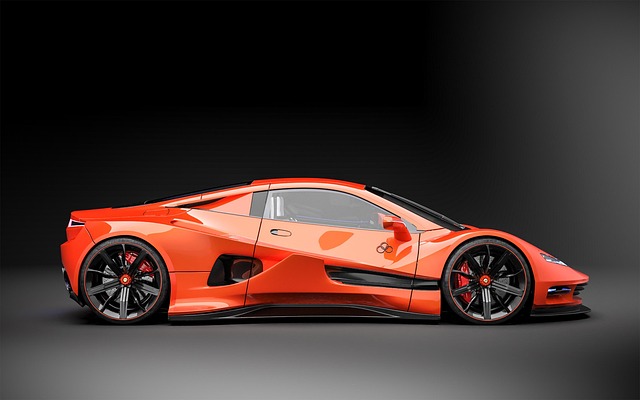

Lacy Lakeview Auto Title Loans offer a unique financial solution for individuals needing quick access to cash. This type of loan utilizes the equity in your vehicle, allowing you to borrow funds by using your car’s title as collateral. It’s a convenient option for San Antonio loans seekers who might be facing unexpected expenses or emergency funds requirements and require a fast and flexible borrowing arrangement.

Unlike traditional loans that often have stringent eligibility criteria, Lacy Lakeview Auto Title Loans cater to a broader range of applicants. This is particularly beneficial for those with less-than-perfect credit histories or limited banking options. The process typically involves providing proof of vehicle ownership, identifying valid government-issued ID, and verifying income. Once approved, you can gain access to funds quickly, making it an attractive choice for situations like paying off medical bills, home repairs, or even funding a hobby, such as Boat Title Loans.

Reading and Interpreting Customer Reviews

When sifting through customer reviews for Lacy Lakeview auto title loans, it’s crucial to approach them with a critical eye. While positive testimonials can be encouraging, it’s essential to look beyond the glowing comments and identify patterns—both in satisfaction and dissatisfaction. Keep an eye out for recurring themes related to San Antonio Loans‘ transparency, interest rates, and the overall customer service experience.

Pay attention to specific details about the loan process, including how easy or difficult it was to apply, approval times, and any unexpected fees. These insights can help you gauge whether a lender is reputable and fair. Remember, a balanced view incorporating both positive and negative reviews will provide a clearer picture of what to expect when considering a title pawn for your auto loan needs.

Tips for Securing the Best Loan Terms

When considering Lacy Lakeview auto title loans, securing the best loan terms involves a few strategic steps. Firstly, compare different lenders to find competitive interest rates and flexible repayment options. Since Lacy Lakeview auto title loans are secured by your vehicle, shop around for the most favorable rates as this can significantly impact your overall cost. Secondly, assess your ability to repay the loan promptly. Being honest about your financial situation will help you choose a repayment plan that aligns with your budget without causing undue strain.

Additionally, explore repayment options offered by different lenders. Some may provide flexible monthly installments while others could offer same-day funding. Opting for a lender that suits your repayment preferences and financial flexibility is crucial. Remember, a title pawn shouldn’t burden you; it should provide the financial support you need.

When considering a Lacy Lakeview auto title loan, understanding the process, reading customer reviews, and securing favorable terms are key. By familiarizing yourself with these steps, you can make an informed decision that best suits your financial needs. Remember to weigh reviews, compare offers, and negotiate for better rates to ensure a positive borrowing experience.