Lacy Lakeview auto title loans provide quick cash access for Fort Worth residents, allowing them to borrow against their vehicle's equity without selling it. Accessible with clear eligibility criteria (18+, valid license, own vehicle outright), these secured loans offer fast funding (within hours) and transparent terms, ideal for urgent needs, with no hidden fees or liens on repaid titles.

“Unraveling the mysteries of Lacy Lakeview Auto Title Loans? This comprehensive guide provides a clear roadmap. Understand the fundamentals, explore the eligibility criteria, and gain insights from frequently asked questions answered succinctly. Lacy Lakeview auto title loans offer a unique financial solution, empowering individuals to access immediate funds using their vehicle’s equity. Dive into this informative piece to make informed decisions in today’s digital era.”

- Understanding Lacy Lakeview Auto Title Loans

- Eligibility Criteria for Title Loans

- Frequently Asked Questions Answered

Understanding Lacy Lakeview Auto Title Loans

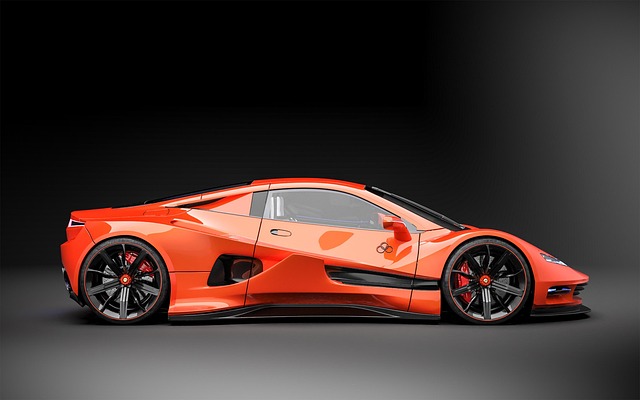

Lacy Lakeview auto title loans are a type of secured loan where borrowers use their vehicle’s title as collateral. This innovative financing option allows car owners to access cash quickly and conveniently, especially in Fort Worth or its surrounding areas. By utilizing the equity in your vehicle, you can obtain funds without selling or sacrificing ownership entirely. It’s a popular choice for those seeking short-term financial relief or emergency money.

These loans are ideal for various purposes, from paying off unexpected bills to funding personal projects. The process is straightforward; you simply apply, providing your vehicle’s details and necessary documents. After approval, you’ll receive the loan amount, and as long as you meet the agreed-upon repayment terms, you get to keep your vehicle. Unlike traditional loans that may require strict credit checks, Lacy Lakeview auto title loans focus more on the value of your vehicle than your credit score, making them accessible to a broader range of individuals, even those with less-than-perfect credit. Keep your vehicle and drive while you repay—it’s as simple as that! Consider Boat Title Loans or any other Fort Worth Loans from reputable lenders for a tailored solution to your financial needs.

Eligibility Criteria for Title Loans

At Lacy Lakeview Auto Title Loans, we understand that unexpected financial needs can arise at any time. To ensure a smooth and efficient process, we have set clear eligibility criteria for our auto title loans. Applicants must be at least 18 years old, possess a valid driver’s license, and have a clear vehicle title in their name. Additionally, we require proof of income to demonstrate your ability to repay the loan.

These secured loans are designed to offer quick funding, making them an excellent option for those requiring fast cash. Unlike traditional loans that can be time-consuming, our auto title loans provide a straightforward and fast solution. We assess each application individually, ensuring a fair process while prioritizing your financial well-being.

Frequently Asked Questions Answered

Lacy Lakeview auto title loans have become a popular choice for many individuals seeking quick funding to cover unexpected expenses or consolidate debts. These loans use the equity in your vehicle as collateral, allowing for a relatively straightforward and efficient process compared to traditional bank loans. One of the significant advantages is the speed at which you can secure funds. Unlike Fort Worth loans that might take days for approval, Lacy Lakeview auto title loans can often provide quick funding within a few hours.

The FAQs section below addresses common concerns about this type of lending. For instance, many wonder if there are any hidden fees associated with these loans. Rest assured, as long as you meet the eligibility criteria and keep up with your payments, you won’t encounter unexpected charges. Additionally, borrowers often inquire about the impact on their vehicle’s title. Once the loan is repaid, the lien is released, returning full ownership rights to the borrower, similar to what you’d experience with Houston title loans.

Lacy Lakeview auto title loans have proven to be a convenient and accessible solution for many individuals seeking quick cash. By understanding the process, eligibility criteria, and addressing common FAQs, you’re now better equipped to make an informed decision. Remember, these loans can offer a reliable financial safety net when managed responsibly.